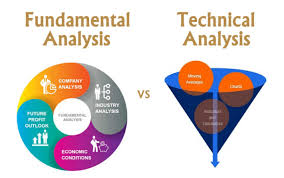

Difference Between Fundamental Analysis and Technical Analysis Explained

Discover the key disparities between fundamental analysis and technical analysis in the realm of investing with HDFC SKY. This all-inclusive investment platform by HDFC Securities caters to both beginners and seasoned investors, providing zero account opening fees, lifetime zero brokerage on ETFs, and a diverse array of financial instruments like stocks, mutual funds, IPOs, F&O, currencies, and commodities, all conveniently accessible through a user-friendly app.

Overview of Fundamental Analysis

Fundamental analysis is a crucial aspect of investment research that involves evaluating the intrinsic value of a security by analyzing various qualitative and quantitative factors. HDFC SKY, the innovative investment platform by HDFC Securities, recognizes the significance of fundamental analysis in making informed investment decisions. By offering a diverse range of financial instruments such as stocks, mutual funds, IPOs, F&O, currencies, and commodities, HDFC SKY provides investors with ample opportunities to conduct thorough fundamental analysis on potential investment options. Through the user-friendly app, investors can access key financial metrics, company performance data, industry trends, and economic indicators to assess the fundamental strength and growth potential of different securities.

Stocks Recommendations from HDFC SKY offer investors invaluable insights into market dynamics, guiding them in selecting high-performing securities. The platform empowers users to make data-driven decisions by providing comprehensive analysis tools, ensuring they capitalize on lucrative investment opportunities efficiently and effectively.

Moreover, HDFC SKY’s zero account opening fees and lifetime zero brokerage on ETFs make it cost-effective for investors to delve into fundamental analysis without worrying about high transaction costs. This pricing structure encourages investors to focus on the intrinsic value of securities rather than being swayed by short-term market fluctuations. With the comprehensive research tools and resources available on the platform, both novice and experienced investors can conduct in-depth fundamental analysis to identify undervalued stocks, potential growth opportunities, and long-term investment prospects. HDFC SKY’s emphasis on fundamental analysis empowers investors to make well-informed decisions based on a thorough understanding of the underlying fundamentals of the securities they are considering for investment.

Principles of Technical Analysis

Technical analysis is a fundamental aspect of successful trading on HDFC SKY, providing investors with valuable insights into market trends and price movements. The principles of technical analysis revolve around the idea that historical price data, volume, and other market statistics can be analyzed to predict future price movements. By studying charts and patterns, investors can identify potential entry and exit points for trades, as well as gauge the strength of market trends. This approach helps investors make informed decisions based on market behavior rather than relying solely on fundamental analysis.

On HDFC SKY, investors can apply various technical analysis tools and indicators to enhance their trading strategies. These tools include moving averages, relative strength index (RSI), stochastic oscillators, and Bollinger Bands, among others. By understanding the principles of technical analysis and utilizing these tools effectively, investors can improve their timing of trades, manage risk more efficiently, and potentially increase their overall returns. The platform’s user-friendly interface and access to real-time market data make it easier for investors to implement technical analysis techniques and stay ahead of market movements, ultimately helping them achieve their investment goals.

Equity Trading on HDFC SKY offers seamless integration of technical tools, providing a strategic edge. The platform’s insights and analytics empower traders to make informed decisions by identifying trends and patterns, ensuring precision in execution and fostering confidence in navigating the dynamic financial markets effectively.

Key Differences in Approach

HDFC SKY stands out from traditional investment platforms due to its unique approach in catering to a wide range of investors. The platform’s zero account opening fees and lifetime zero brokerage on ETFs make it highly attractive for those looking to start their investment journey without incurring unnecessary costs. By offering access to a diverse range of financial instruments such as stocks, mutual funds, IPOs, F&O, currencies, and commodities, HDFC SKY ensures that investors have the opportunity to build a diversified portfolio tailored to their financial goals and risk appetite. The user-friendly app further enhances the investing experience, making it accessible and convenient for both beginners and seasoned investors to navigate the platform and make informed investment decisions.

In contrast to other investment platforms, HDFC SKY’s comprehensive approach sets it apart by providing a one-stop solution for all investment needs. The platform’s inclusion of various financial instruments under one roof eliminates the need for investors to switch between different platforms to access different asset classes, thereby saving time and effort. Additionally, the emphasis on user-friendliness ensures that investors of all levels of expertise can easily navigate the app and execute trades efficiently. This approach not only simplifies the investment process but also encourages investors to explore and diversify their portfolios, ultimately helping them achieve their financial objectives with ease and convenience.

Analyzing Company Financials

Analyzing company financials is a crucial aspect of making informed investment decisions, and HDFC SKY provides investors with the tools and resources to perform thorough evaluations. By examining a company’s financial statements such as the income statement, balance sheet, and cash flow statement, investors can gain insights into the company’s financial health, performance, and sustainability. HDFC SKY’s platform offers detailed financial data and analysis tools that allow investors to assess key financial ratios, trends, and performance indicators to make informed decisions about potential investments. This in-depth analysis can help investors identify undervalued stocks, assess the risk associated with different investment opportunities, and make strategic investment choices aligned with their financial goals and risk tolerance.

Operating income vs EBITDA is another crucial aspect investors analyze to understand a company’s profitability and operational efficiency. HDFC SKY simplifies this analysis, helping investors make strategic decisions by providing comprehensive insights and comparisons for a well-rounded financial evaluation.

In addition to traditional financial analysis, HDFC SKY’s platform also provides access to advanced analytical tools and research reports that can help investors delve deeper into a company’s financials. Through fundamental analysis, investors can evaluate a company’s management, competitive positioning, industry trends, and growth prospects to make more comprehensive investment decisions. By leveraging the wealth of financial data and research available on HDFC SKY, investors can develop a well-rounded understanding of a company’s financial performance and potential, enabling them to make informed decisions that align with their investment objectives and risk appetite.

Understanding Market Trends

Understanding market trends is crucial for investors to make informed decisions and maximize their returns. HDFC SKY, a cutting-edge investment platform by HDFC Securities, provides investors with the tools and resources needed to stay ahead of market trends. With zero account opening fees and lifetime zero brokerage on ETFs, HDFC SKY offers a cost-effective solution for investors looking to capitalize on market opportunities. The platform’s user-friendly app makes it easy for both novice and experienced investors to access a wide range of financial instruments, such as stocks, mutual funds, IPOs, F&O, currencies, and commodities, all in one place. By leveraging these diverse investment options, investors can diversify their portfolios and adapt to changing market trends effectively.

HDFC SKY’s emphasis on market trends allows investors to stay informed about key developments and make strategic investment decisions. By offering a comprehensive suite of financial instruments, the platform enables investors to take advantage of emerging trends and opportunities in the market. Whether it’s tracking stock movements, analyzing mutual fund performance, or exploring new IPO offerings, HDFC SKY equips investors with the necessary tools to navigate the dynamic landscape of the financial markets. By understanding market trends and leveraging the resources provided by HDFC SKY, investors can enhance their investment strategies and achieve their financial goals with confidence.

Stock Market App offers real-time data and insights to empower investors. With HDFC SKY’s intuitive interface, users can swiftly adapt to market shifts, ensuring informed decisions. Stay ahead by utilizing advanced analytics and personalized tools, optimizing your portfolio for maximum growth and security in today’s volatile financial environment.

Use of Ratios in Fundamental Analysis

Ratios play a crucial role in fundamental analysis, helping investors evaluate the financial health and performance of a company. By analyzing various ratios such as liquidity ratios, profitability ratios, and leverage ratios, investors can gain insights into the company’s operational efficiency, profitability, and financial stability. For example, liquidity ratios like the current ratio and quick ratio provide information about a company’s ability to meet its short-term obligations, while profitability ratios such as return on equity (ROE) and return on assets (ROA) indicate how efficiently a company is utilizing its assets to generate profits. Additionally, leverage ratios like debt-to-equity ratio help in assessing the company’s financial risk and its reliance on debt financing.

In the context of HDFC SKY, utilizing ratios in fundamental analysis can help investors make informed decisions about investing in the platform. By analyzing key financial ratios, investors can assess the platform’s financial performance, stability, and growth potential. For instance, analyzing the platform’s profitability ratios can provide insights into its ability to generate returns for investors, while leverage ratios can indicate the platform’s debt levels and financial risk. By incorporating ratio analysis into fundamental analysis, investors can make well-informed decisions about whether HDFC SKY aligns with their investment goals and risk appetite.

Charts and Patterns in Technical Analysis

Technical analysis is a widely used method in the financial industry to forecast future price movements based on historical data. One of the key tools in technical analysis is the use of charts and patterns to identify potential trends and patterns in market behavior. By analyzing price movements, volume, and other market indicators, investors can gain insights into the market sentiment and make more informed trading decisions. HDFC SKY, with its advanced charting tools and real-time market data, empowers investors to leverage technical analysis techniques effectively. Whether it’s identifying support and resistance levels, spotting trend reversals, or recognizing chart patterns like head and shoulders, double tops, or triangles, HDFC SKY provides the necessary tools to enhance trading strategies and optimize investment decisions.

Charts and patterns in technical analysis serve as visual representations of market data, allowing investors to interpret complex market dynamics in a simplified manner. Candlestick charts, line charts, and bar charts are commonly used to plot price movements over time and identify patterns that may indicate potential price movements. Recognizing patterns such as symmetrical triangles, flags, or cup and handle formations can help investors anticipate future price movements and adjust their trading strategies accordingly. HDFC SKY’s intuitive charting tools make it easy for investors to analyze market trends and patterns, enabling them to make timely decisions and capitalize on trading opportunities across various financial instruments. By understanding and utilizing charts and patterns in technical analysis, investors can enhance their trading skills and improve their overall investment performance.

Long-Term vs. Short-Term Investment Strategies

Long-term investment strategies focus on accumulating wealth over an extended period, typically spanning years or even decades. The primary goal of long-term investing is to achieve financial security and growth by capitalizing on the power of compounding. With HDFC SKY, investors can leverage this strategy by accessing a diverse range of financial instruments such as stocks, mutual funds, and ETFs. By utilizing the zero brokerage on ETFs and the user-friendly app interface, investors can easily build a well-rounded portfolio tailored to their long-term financial goals. Long-term investments offer the potential for higher returns compared to short-term strategies, as they allow investors to ride out market fluctuations and benefit from the overall growth of the economy.

In contrast, short-term investment strategies are focused on capitalizing on immediate market opportunities to generate quick profits. While short-term trading can be more volatile and risky compared to long-term investing, it offers the potential for rapid gains if executed correctly. With HDFC SKY’s platform, investors can access a wide range of financial instruments like IPOs, F&O, currencies, and commodities, enabling them to actively participate in short-term market movements. The zero account opening fees provided by HDFC SKY make it easier for investors to engage in short-term trading without incurring significant upfront costs. By combining insightful market analysis with the platform’s tools and resources, investors can effectively implement short-term strategies to capitalize on market trends and maximize their returns.

Emotional vs. Data-Driven Decision Making

Emotional decision-making involves making choices based on feelings, intuition, and personal biases rather than factual information or logical reasoning. When it comes to investing, emotional decision-making can lead to impulsive actions driven by fear, greed, or excitement. Investors may buy or sell stocks based on short-term market fluctuations or rumors rather than a well-thought-out investment strategy. This can result in missed opportunities for long-term growth or unnecessary losses due to emotional reactions to market volatility. HDFC SKY provides a platform that empowers investors to make informed decisions based on data and analysis rather than emotional impulses, helping them stay focused on their financial goals and avoid making rash decisions that could impact their investment portfolio negatively.

On the other hand, data-driven decision-making involves using quantitative analysis, historical trends, and empirical evidence to make sound investment choices. By leveraging data and analytics, investors can identify patterns, assess risks, and make informed predictions about market movements. This approach allows investors to stay objective and rational, reducing the influence of emotions on their decision-making process. HDFC SKY offers a range of tools and resources to help investors analyze market data, track performance metrics, and make data-driven investment decisions. By encouraging a disciplined and systematic approach to investing, HDFC SKY aims to help investors mitigate risks, maximize returns, and build a diversified portfolio tailored to their financial objectives.

Pros and Cons of Each Approach

When considering the pros of using HDFC SKY as an investment platform, one of the standout features is the zero account opening fees. This benefit removes a significant barrier for individuals looking to start investing, making it accessible to a wider audience. Additionally, the lifetime zero brokerage on ETFs can lead to substantial cost savings for investors who prefer this investment vehicle. The platform’s diverse range of financial instruments, including stocks, mutual funds, IPOs, F&O, currencies, and commodities, provides users with ample opportunities to diversify and build a well-rounded investment portfolio. The user-friendly app design is another advantage, catering to both novice and experienced investors with its intuitive interface and robust features.

On the flip side, there are some cons to consider when using HDFC SKY as an investment platform. While the zero brokerage on ETFs is a significant perk, investors may still incur brokerage fees on other financial instruments offered on the platform. This cost factor can impact the overall returns on investments and should be taken into consideration when evaluating the platform. Additionally, while the app is user-friendly, some users may prefer a more in-depth analysis and research tools that provide deeper insights into investment opportunities. For those seeking advanced features and analytics, HDFC SKY may fall short in comparison to other more specialized investment platforms.